What is an Earnest Money Deposit in Maryland?

Homebuyers may not always need a down payment when they need to get a loan. For example, the USDA loan requires no downpayment whatsoever. However, what buyers often don’t know is that they will need cash to use for an “earnest money deposit” (also known as “Good Faith Money, EMD or House Deposit”). This money can either be provided by the buyers themselves, or gifted from a family member.

Earnest Money Deposit Definition / Real Estate EMD Definition / Good Faith Deposit Real Estate

Many home buyers (and sometimes home sellers, too) often ask “What is an emd in real estate?” OR “What is a good faith deposit when home buying?” Others might ask “Is there such thing as a real estate deposit?”

All of these terms actually mean the same thing. Good faith money, Good faith payment, Contract deposit, and Earnest money. These are all real estate terms that refer to the same thing….the amount of money that a buyer offers to initially put down when making an offer on a house. This is not the same thing as the amount of downpayment a buyer might need to put down for their loan.

An earnest money deposit sets in advance – at the time of contract formation – what the monetary value of damages shall be in the event of contract breach by one of the parties.

In other words, should the buyers fail to hold up their end of the bargain, the seller agrees not to sue, but instead to keep the amount of the earnest money deposit. Keep in mind, the seller ONLY gets to keep the money when the buyer breaches the sales contract. Likewise, if the sellers fails to hold up their end of the sales contract, the buyers can get their earnest money back. More details about this scenario are below.

Is Earnest Money Required?

Technically, according to the Maryland earnest money deposit law, earnest money in Maryland is not required. However, it’s an initial deposit that is customarily submitted with an offer, and part of the contract, to purchase a house in Maryland. Home sellers expect a buyer to make that initial deposit as proof that the buyer is serious about buying the property. It’s like a “security deposit” or “putting a house on layaway” until the loan is approved.

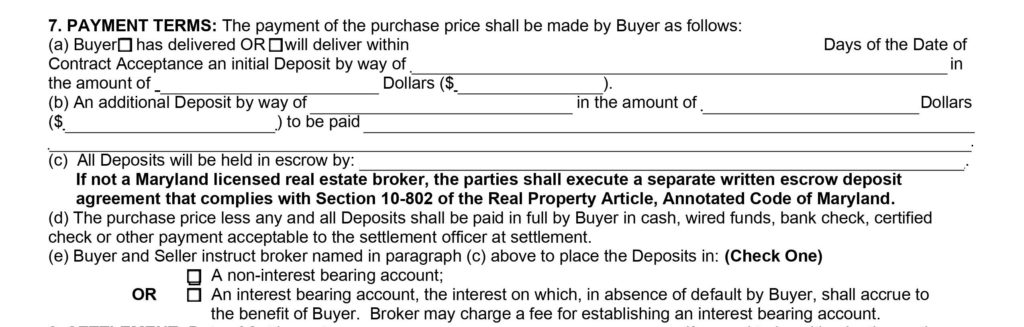

(Example of the part of the Contract where Earnest Money is Specified)

What is Earnest Money Used For? / How Does an Earnest Money Deposit Work?

This deposit takes its name from its purpose: It shows the sellers the buyers are earnest about following through with the transaction to purchase their house – the buyers are, in essence, “putting some skin in the game”. It shows sellers that you, as a buyer, are serious about buying their house. It lets them know you are willing to have a certain amount of money sit in an account until you become the new owner.

How Much Earnest Money Is Required? / What is a Decent Good Faith Deposit Amount?

The amount of earnest money a buyer needs to deposit will vary by the area, the purchase price, and also by what a homeowner might require. One percent of the purchase price is standard in some areas in Maryland. In other areas, the Earnest Money Deposit my be $500 or $1,000. Typically, the higher the price of a house, the higher the earnest money deposit. In a seller’s market, buyers who are competing with other buyers for the same house should consider offering a higher amount. Home sellers take into consideration the amount of earnest money that a buyer is willing to put down. Buyers who offer higher amounts are viewed as “stronger buyers” who have the financial ability to buy the house without any loan issues.

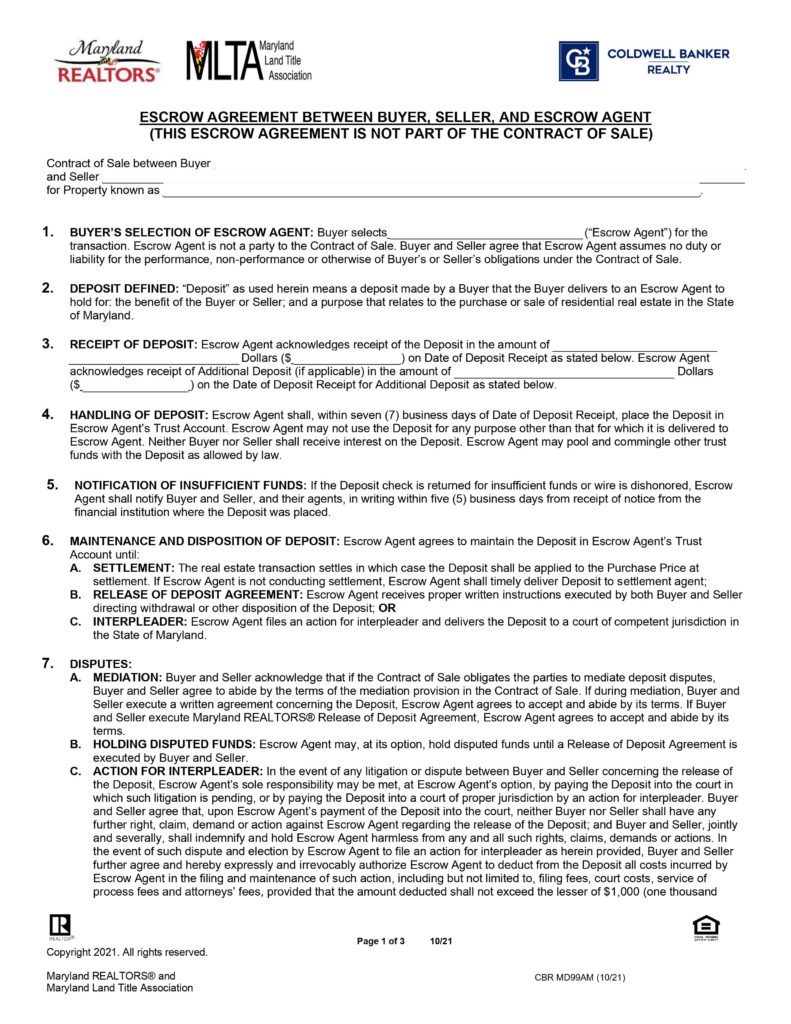

Good Faith Deposit Agreement Form / Escrow Agreement

The Maryland contract of sale stipulates the terms of the earnest money deposit. If a title company is going to hold onto the earnest money, an escrow agreement form is used in Maryland, and is included with the initial offer to buy a house. This form indicates what happens to the money, and is a legally-binding document.

Example of the Maryland Real Estate Escrow Agreement

What Happens if a Buyer Does Not Deposit Earnest Money?

A buyer in Maryland who does not deposit earnest money has little chance of having their offer accepted. This is because sellers want to know buyers are serious and willing to make an initial deposit.

How to Pay Earnest Money

An earnest money check, also know as a good faith check, can be written and submitted for deposit. Either a personal check or cashier’s check will typically suffice. Another option is to send a wire to the the title company of real estate brokerage that will be holding your money until closing.

When is Earnest Money Due?

When your offer is written, there is a blank that is filled in that says you will pay your earnest money within “X” number of days.

Who Gets the Earnest Money?

In Maryland, earnest money is deposited into a non-interest-bearing account. It is NOT deposited into an account that belongs to the seller. Instead, earnest money is deposited into a 3rd-party account that is managed by either a title company, or a real estate brokerage. In most home sale transactions in Maryland, the buyer is able to choose whether the title company or the buyers agent’s brokerage deposits the earnest money. Some real estate brokerages in Maryland will not hold these monies. When that is the case, the title company will deposit the money and hold onto it until closing. Occasionally, the sellers agent’s brokerage will prefer to deposit the earnest money.

Can You Lose the Earnest Money Deposit?

Every real estate contract is different. It is important for both buyer(s) and the seller(s) to follow the terms of the contract so the earnest money doesn’t have to be forfeited. If buyers default on the terms of the contract, yes, they stand to lose their earnest money deposit. Likewise, if the sellers default, the buyers may be entitled to have their earnest money returned to them.

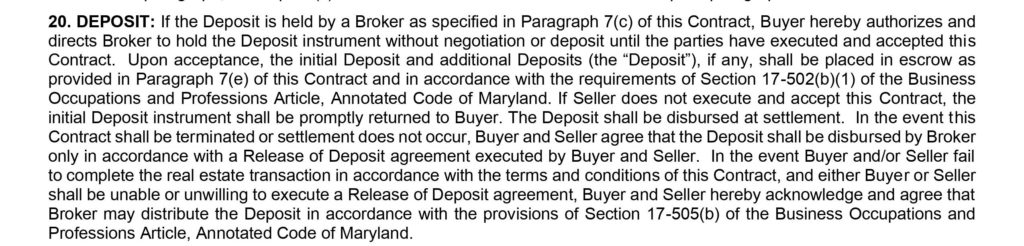

Example of the terms of the Escrow Agreement in the Maryland real estate contract

Good Faith Deposit Refund / Return of Earnest Money

There are specific items in the contract that allow buyers to have their earnest money returned when appropriate. This is a time where it’s extremely important to have a buyer’s agent in your corner. For example, if you’re buying a house “as is” and having some inspections done, you can back out of the contract within a certain timeframe if you don’t like some of the inspection results. This will allow you to have your money returned. If you aren’t buying a house “as is” and are having some inspections done, your first course of action is to ask the seller to make some repairs if there are any mechanical or structural issues. If the seller and you don’t reach an agreement, you can back out of the contract and have your money returned to you. It’s key that you follow the timeframe in your contract in order to get your money back. A reliable buyer’s agent will keep track of the timeframe to make sure you don’t end up losing your money.

Another example where you can get your money back is if, heaven forbid, your loan gets denied. If that happens, you are entitled to having your earnest money returned to you.

When buyers seek to have their money returned, there is a Maryland form that must be completed. Again, a reliable buyers agent will guide you and assist you with this process.

If the seller is refusing to release the earnest money, the money stays in the account until both parties come to a resolution. There have been instances where the differences have never been resolved, and the money has stayed in the account for years.

How Can I Make Sure My Earnest Money is Protected?

What is the best way to make sure earnest money is properly protected? When buying a property in Maryland, be sure to hire a Buyer’s Agent (there is no charge) who will best represent you and your money, and will make sure the terms of the contract are upheld.

How is Earnest Money Applied at Closing? / Do Your Get Your Earnest Money Back at Closing?

The amount of the earnest money is applied towards the buyer’s total closing costs. It gets subtracted from the total amount due at closing. It is not issued as a refund. However, if it turns out you wired too much money for your closing costs, (yes, title companies require large amounts to be wired) you will be issued a check for the difference. Why are wires required? Because in Maryland, the title company needs to receive your funds in advance of your closing. If you write a check for a large amount, it will need to clear your bank first, and you won’t be able to close on your settlement date.

The Bottom Line…

Maryland buyer’s agents best know the areas in which they work, and are able to counsel their clients in the amount of earnest money deposit they should make when buying a house in Maryland.

Like many aspects of the residential purchase agreement, the amount of earnest money to deposit is negotiable so – whether you are the buyer or the seller — hire a knowledgeable real estate agent who can counsel you wisely.

Thinking About Buying a House in Maryland?

Visit Melissa’s YouTube Channel for more real estate tips & advice

About the Author:

Melissa Spittel is a local real estate expert who serves Carroll County and the surrounding counties in Maryland. Her knowledge, skills and experience are invaluable when it comes to buying or selling a house. Her creative strategies enable home sellers to sell their house as quickly as possible and for the most money. Melissa is also skilled in helping buyers get the house they want despite the currently competitive real estate market. Her experience working with out-of-state buyers and sellers makes her a great relocation REALTOR®, and she is part of Coldwell Banker’s Relocation Team. Do you need a real estate expert in another part of Maryland? Or even in another state? Melissa can easily connect you with a REALTOR® from her wide network of real estate pros.

Have a Local Real Estate Expert Help You AND Get Answers to Your Questions Here…